Liquid Super Communities ARE HOT

Token gating, Discord, and more... internet native communities are built different 😤

first, a word from me

Hey everyone welcome to the first Internet of Value post! I can’t believe how many people signed up from just one under-the-radar tweet…. I’ve been looking forward to writing this all week (albeit I’m a chronic procrastinator).

🚨 Here’s something special. If you’re reading this because you subscribed and it was delivered to your inbox, you get to claim an inaugural POAP. No clue what a POAP is? Read here, but the TLDR is that it’s a digital collectible (NFT). A sort of badge saying, “Hey I was an early subscriber of Internet of Value even before the first post”. Let me know if this is your first NFT. This is the internet of value after all.

Claim Instructions: Respond to this newsletter email with just “POAP”. You’ll receive a reply with a custom link to mint your POAP.

media that caught my attention last week

my weekly alpha

Tokemak amasses and directs liquidity in DeFi. Think of it like community-controlled liquidity that can be directed to new projects to help bootstrap a healthy ecosystem. You can read more on their website, but this past week they finished the “degenesis“ event, effectively bootstrapping its liquidity and distributing $TOKE which is used to vote on where liquidity is routed. I participated in the degenesis event, and am now staking $toke in the staking pool which is sitting at roughly ~200% APR, something that is a no-brainer if you’re bullish on the project. The funny thing is the front end had some bugs that prevented users from depositing leftover funds from degensis into the USDC pool. I had to manually construct my transaction with the contract to get in early — shoutout to this site for making it way easier.

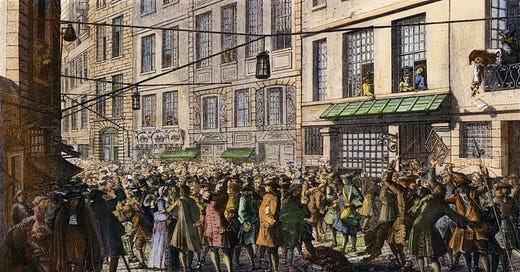

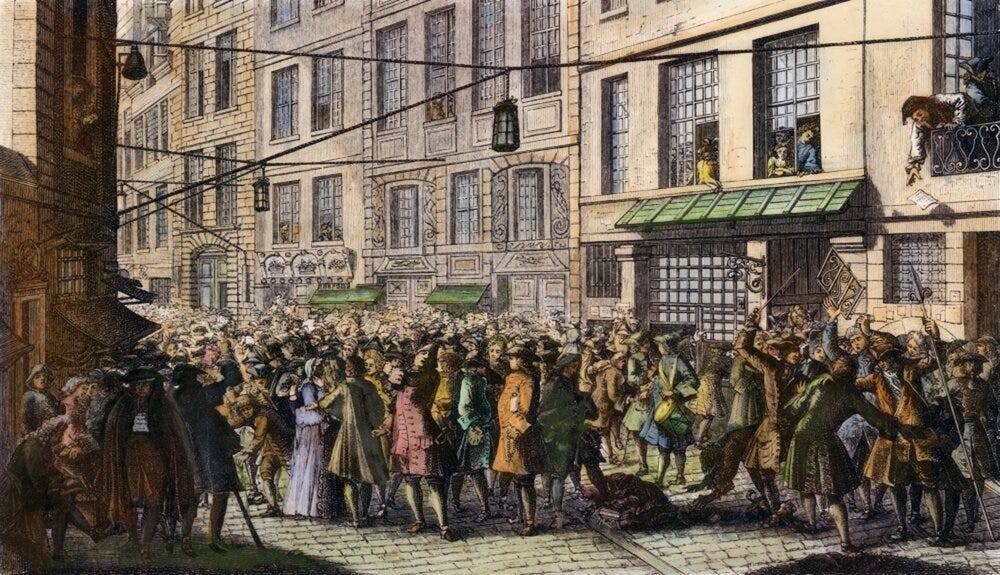

Liquid Super Communities

There’s a recent article by Packy McCormick that made rounds for describing “liquid super teams.” It’s a neat way of thinking about how small teams can come together online and build a digital product quickly, efficiently, and without the burden of a traditional company with an HR department 😬.

I think this idea can be expanded to liquid super communities. In the era of web3.0, projects & startups derive value from their community, especially in the early days. These early communities tangibly contribute to marketing, development, and governance. Unlike web2 counterpart communities, these communities stand to be rewarded without friction.

The community stack for crypto has (roughly) been

Place: Discord

Wealth: Governance and/or utility tokens

Polls: Snapshot

Tokens are what make super communities liquid. What used to be restricted to organic & fragile growth is now exponential & antifragile. Take a look at Friends with Benefits — an obviously high-value group of people that will slowly but surely attract more awesome people if it were on a web2 forum like Reddit. The difference? Token-gated Discord. There are 1M FWB tokens in existence, and you need 75 at the time of writing to join.

I joined when the requirement was 60 tokens, requiring me to swap ~$300 of ether on Uniswap to join. Unlike a country club, my tokens never leave my custody. Depending on market prices, my “membership” can likely be sold without a loss of capital. What drives the market here then? Demand to be in the community. The special part? People can join and leave, either enriching the community with their presence or detracting with their departure. This is directly measurable by the current cost of membership.

The innovative model here is in the EARLY days. The monetary rewards and wealth creation of these communities will A) drive development for infrastructure tooling and B) lead to wackier experiments (see Partybid 🙌🏼).

There are a few extraneous catalysts also happening:

Smart contract platforms are proliferating. Ethereum is on the cusp of Eth2.0, Polygon has full blocks (it’s highly utilized because it’s a cheaper Ethereum experience), and Solana is ridiculously performant.

The world is harder to get around, yet talent is cropping up everywhere. What other way to coordinate valuable activities with your friends in India and Argentina than through a shared bank account and community on a blockchain?

I guess the real reason I wanted to write about this is token gating. I think token gating is underrated and far more innovative than people realize. We’ve grown used to a world with digitally gated events (i.e. concert tickets and such). But there’s no standard here. Tokens on-chain are ERC20 (super easy and quick to spin up), can be used for financial leverage, can be composed into other apps, can be read by 3rd parties, and are a digital collectible that won’t break if a server goes down ;’) I postulate you can’t route value in web2.

That’s it. There’s a lot more to be talked about here, but it’s likely I’ll be diving into something more technical next week to stretch that muscle. If you’re not part of a DAO or web3 community, I always like to recommend the Discord of Seedclub as a way to get started. From there you might be interested in FWB or maybe SquiggleDAO 🤔. More to come on our very own Gen Z DAO as well for all the zoomers out there.

poap

poap